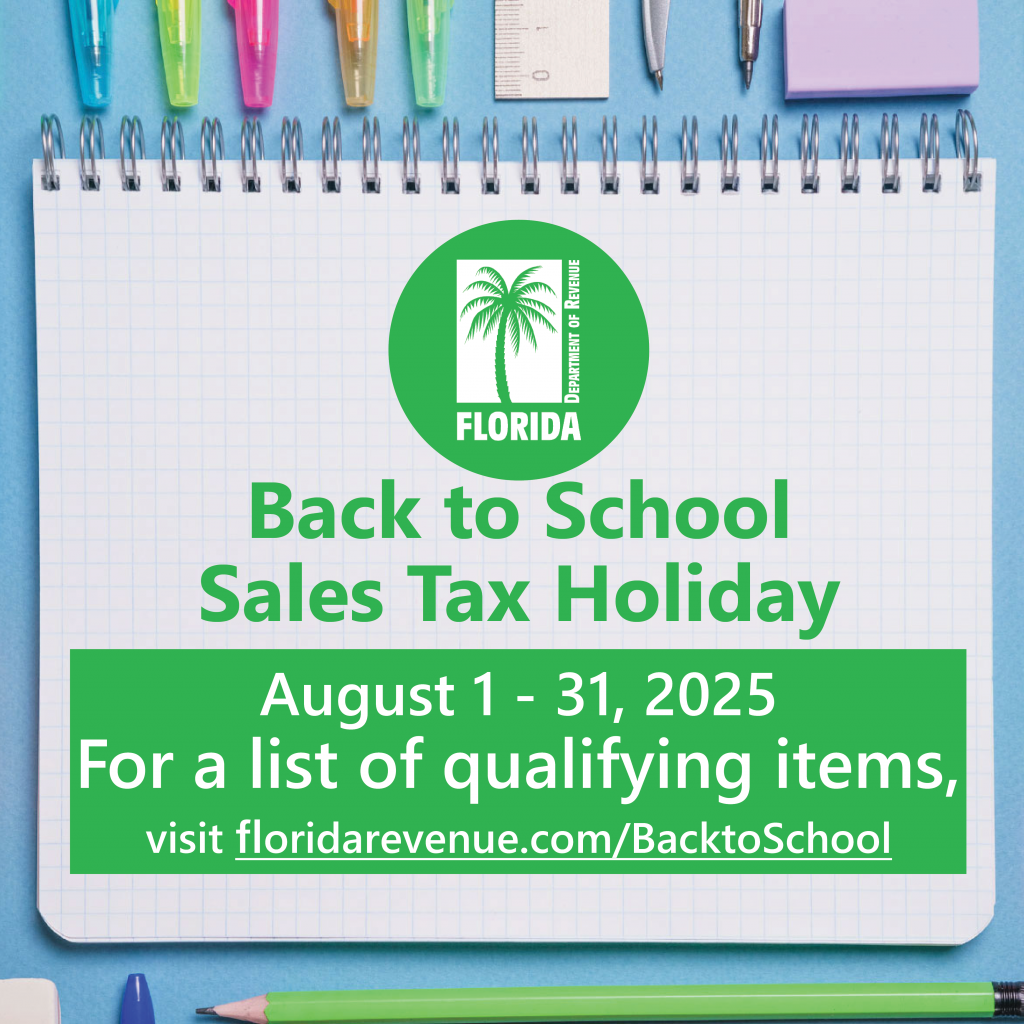

It’s shopping time! With the first day of school right around the corner, the Back to School Sales Tax Holiday will run from August 1 through August 31, 2025. This is the time to purchase any school-related items in preparation of 2025-2025 school year. Here is everything you need to know to take advantage of the sales tax holiday!

What items are exempt?

Below are the qualifying items based on their intended use and price, according to the Florida Department of Revenue.

Items up to $1,500

You may purchase the following computer-related items for “noncommercial home or personal use” with a sales price of up to $1,500:

-

Calculators

-

Desktops

-

Electronic book readers

-

Handhelds

-

Laptops

-

Tablets

-

Tower computers

-

Keyboards

-

Mice

-

Modems

-

Monitors

-

Non-recreational software

-

Other peripheral devices

-

Personal digital assistants

-

Routers

Items up to $100

You may purchase the following clothing-related items with a sales price of up to $100:

-

All footwear (excluding skis, swim fins, roller blade, and skates)

-

Articles of apparel “intended to be worn on or about the human body,”

(excluding watches, watchbands, jewelry, umbrellas and handkerchiefs) -

Backpacks

-

Diaper bags

-

Fanny packs

-

Handbags

Items up to $50

You may purchase the following school supply-related items with a sales price of up to $50:

-

Binders

-

Cellophane tape

-

Compasses

-

Composition books

-

Fanny packs

-

Computer disks

-

Construction paper

-

Crayons

-

Erasers

-

Folders

-

Glue or paste

-

Legal pads

-

Lunch boxes

-

Markers

-

Notebooks and notebook paper

-

Pencils

-

Pens

-

Poster board and poster paper

-

Protractors and rulers

-

Scissors

-

Staplers and staples

Items up to $30

You may purchase learning aid-related items with a sales price of up to $30. Learning aids are items that assist learning or help teach reading or math skills. These include:

-

Electronic books

-

Flashcards or learning cards

-

Interactive books

-

Jigsaw puzzles

-

Matching or other memory games

-

Puzzle books and search-and-find books

-

Stacking or nesting blocks or sets

-

Toys that teach reading or math skills

What items are not exempt?

The sales tax holiday does not apply to:

-

Clothing-related items over $100

-

School supply-related items over $50

-

Learning aid-related items over $30

-

Books “that are not otherwise exempt”

-

Computers-related items over $1,500

-

Computer-related items for commercial purposes

-

Rentals of any items

-

Repairs/alterations of any items

-

Eligible items found “within a theme park, entertainment complex, public lodging

establishment or airport”

Other important considerations

-

Qualifying items with sales prices higher than the respective limit are not exempt, and you must pay tax on the price of the entire item

-

There is no limit to the number of items you can purchase

-

You may purchase qualifying items online as long as the order is accepted during the tax holiday period (delivery can be made after the tax holiday ends)

You can view a video from the Florida Department of Revenue here.

Related articles

ACPS Posts Updated School Calendar

Middle School Success: How To Prepare Your Middle Schooler

Put a Stop to Back-to-School Blues!